Evergrande Debt Ratio

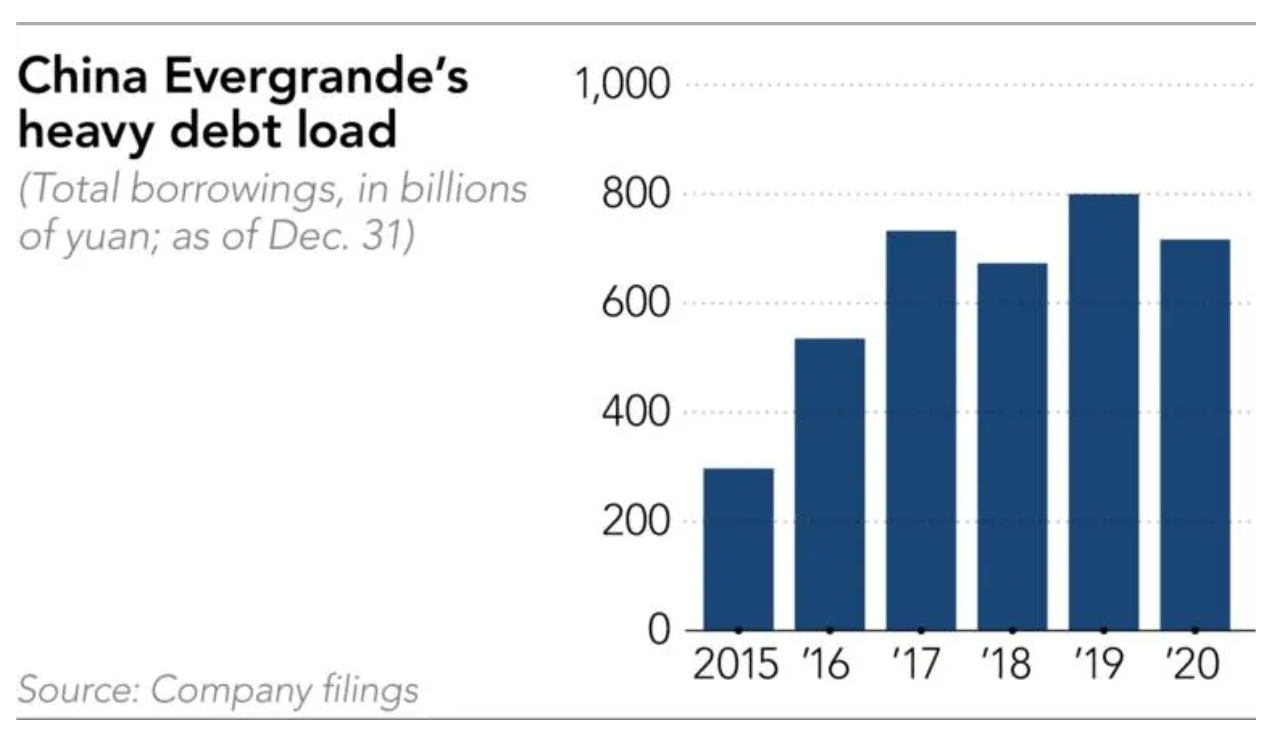

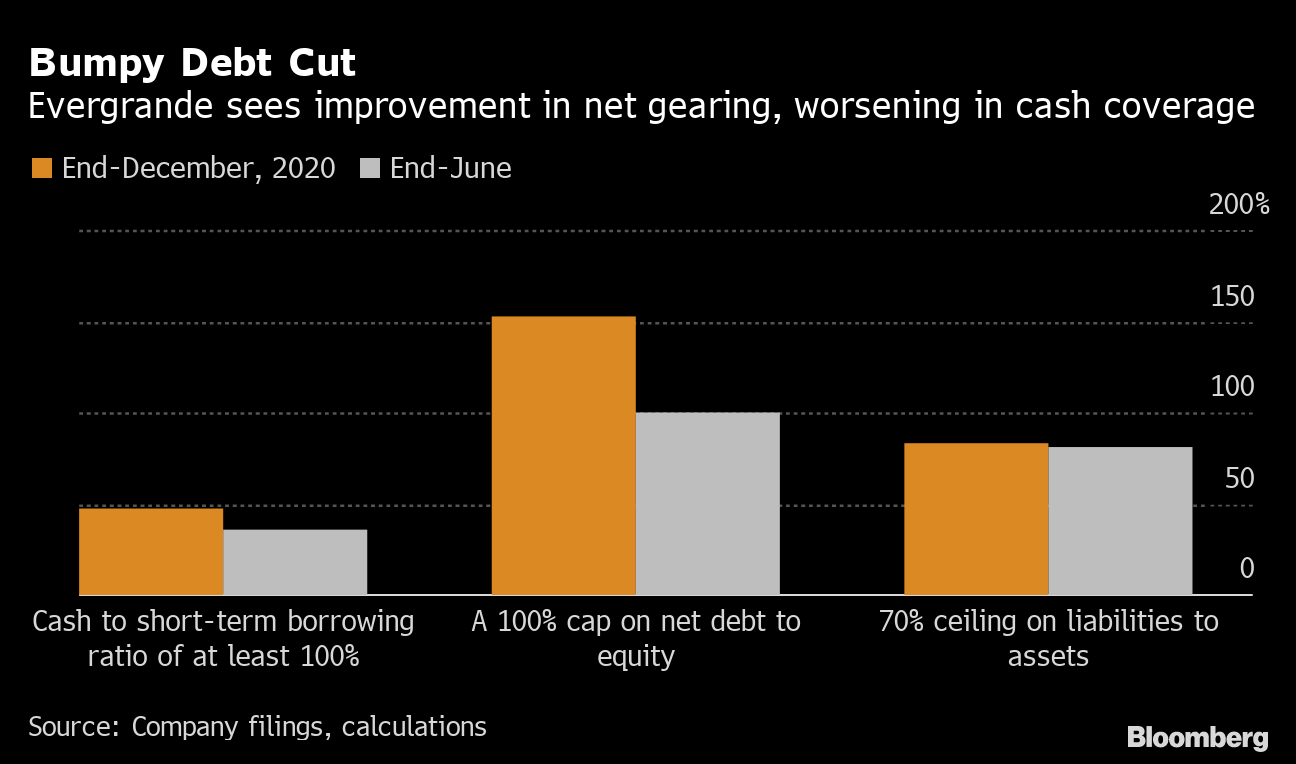

Evergrande achieves one of the debt ratio caps set by regulators by cutting its interest-bearing indebtedness to around 570 billion yuan from 7165 billion yuan. What it is and why it matters.

As the company struggles to repay creditors Global markets have responded with selloffs.

Evergrande debt ratio. As Evergrande scrambles to raise funds to pay off debt regulators. Chinas second largest Real Estate company Evergrande is over 305B in debt. Chinas Evergrande debt crisis.

Questions loom about a government bailout and whether Evergrande. A net gearing ratio of less than 100 and a cash-to-short-term debt ratio of at. Chinas Evergrandes shares pummelled on fear of debt default.

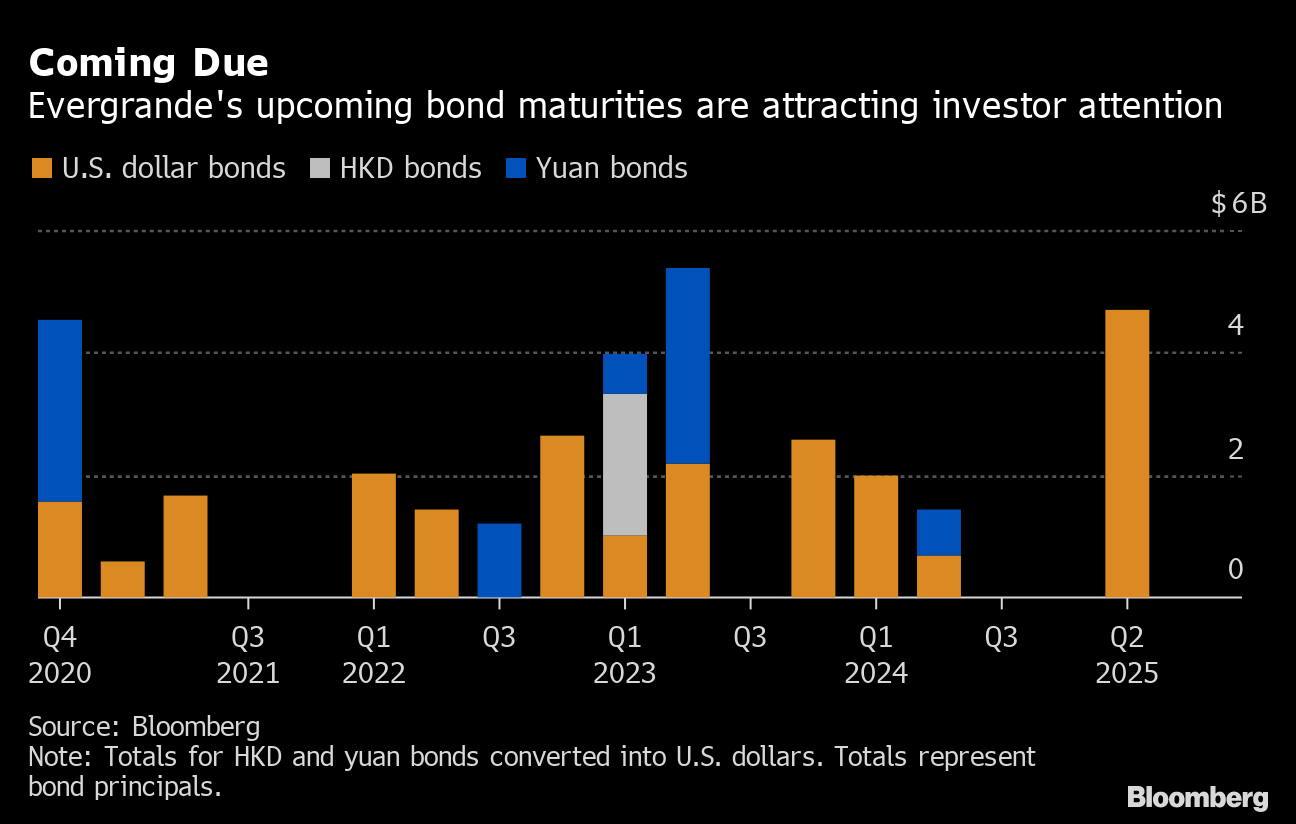

Evergrande Squeezed By 53 Billion Of Maturities In Tough Market

Evergrande Seeks Safe Descent From Usd 130 Billion Debt Mountain Krasia

China S Scrutiny Of Shadow Debt Bites Developers Like Evergrande Bloomberg

/cloudfront-us-east-2.images.arcpublishing.com/reuters/65B7QMZXSVISHAHFEJEH6WDSAA.jpg)

Explainer How China Evergrande S Debt Woes Pose A Systemic Risk Reuters

Understanding China S Evergrande Crisis Forbes Advisor

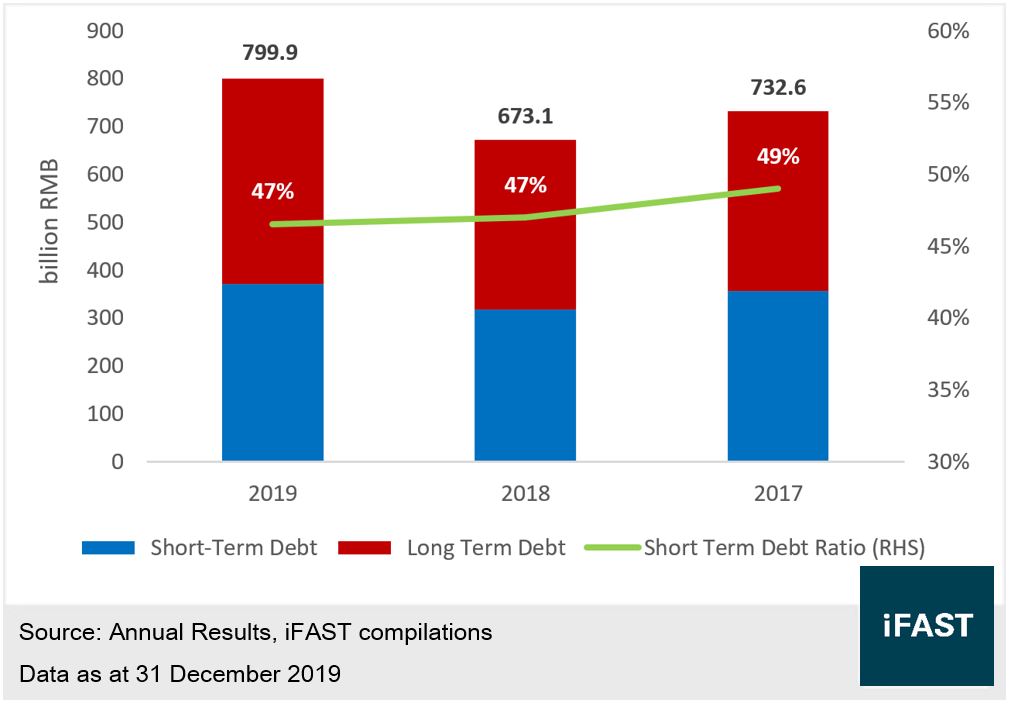

Evergrande Entering The Era Of Deleveraging Bondsupermart

Evergrande Faces Crisis Of Confidence Over 120 Billion Debt Bloomberg

China Evergrande Profit Drops As Developer Seeks To Ease Cash Crunch Bloomberg